When people mention “Open Interest” (OI), it can sound like some technical jargon reserved for experts. But the truth is, it’s much simpler than it seems. Are you also the one who is still wondering what does open interest indicates?

Well, let’s keep it simple.

OI is basically a headcount of how many options or futures contracts are still active.

Think of it like a cricket stadium. Some fans walk in, some walk out, but at the end of the day, OI tells you how many people are still sitting and watching the match.

In this blog, we will break down the concept of open interest, what it indicates and how to use this data for your trading.

What does Open Interest indicate in the Stock Market?

At its core, OI is the number of outstanding contracts that haven’t been closed, expired, or exercised.

- Fresh contracts added: OI increases.

- Contracts closed or squared off → OI decreases.

- Contracts simply shifting between traders → OI stays the same.

Now most of you might be thinking How is it different from volume.

Well, volume measures the number of trades that happened in the day, while open interest shows the number of contracts that are open at the end of the day.

Here’s how it works in practice:

- Day 1: Trader A buys 10 call options from Trader B: OI = 10.

- Day 2: Trader C steps in with 5 more new contracts: OI = 15.

- Day 3: Trader A exits 7 contracts: OI drops to 8.

That’s it. OI is just a running total of how many positions are still alive.

Why OI Matters to Traders

Where it gets powerful is when you combine OI with price action. Together, they reveal the market’s mood:

- Price up + OI up: Fresh buying = bullish sentiment.

- Price down + OI up: New selling = bearish sentiment.

- Price up + OI down: Sellers closing positions = short covering.

- Price down + OI down: Buyers exiting = long unwinding.

Put simply, OI tells you if a move has real conviction behind it, or if it’s just a passing wave.

How Traders Use OI

Traders generally don’t only use open interest to determine support & resistance levels. Instead, they interpret the data for:

- Liquidity check: High OI means smoother entries and exits with tighter spreads.

- Spotting levels: The strikes with the most OI often act as support or resistance zones.

- Trend confirmation: Rising OI with price movement usually signals a stronger, more reliable trend.

Understanding Open Interest Data: A Real Example

Since Open Interest (OI) shows market positioning, in simple terms, if you are confused about how to choose a strike price for options, OI data can help you make a decision.

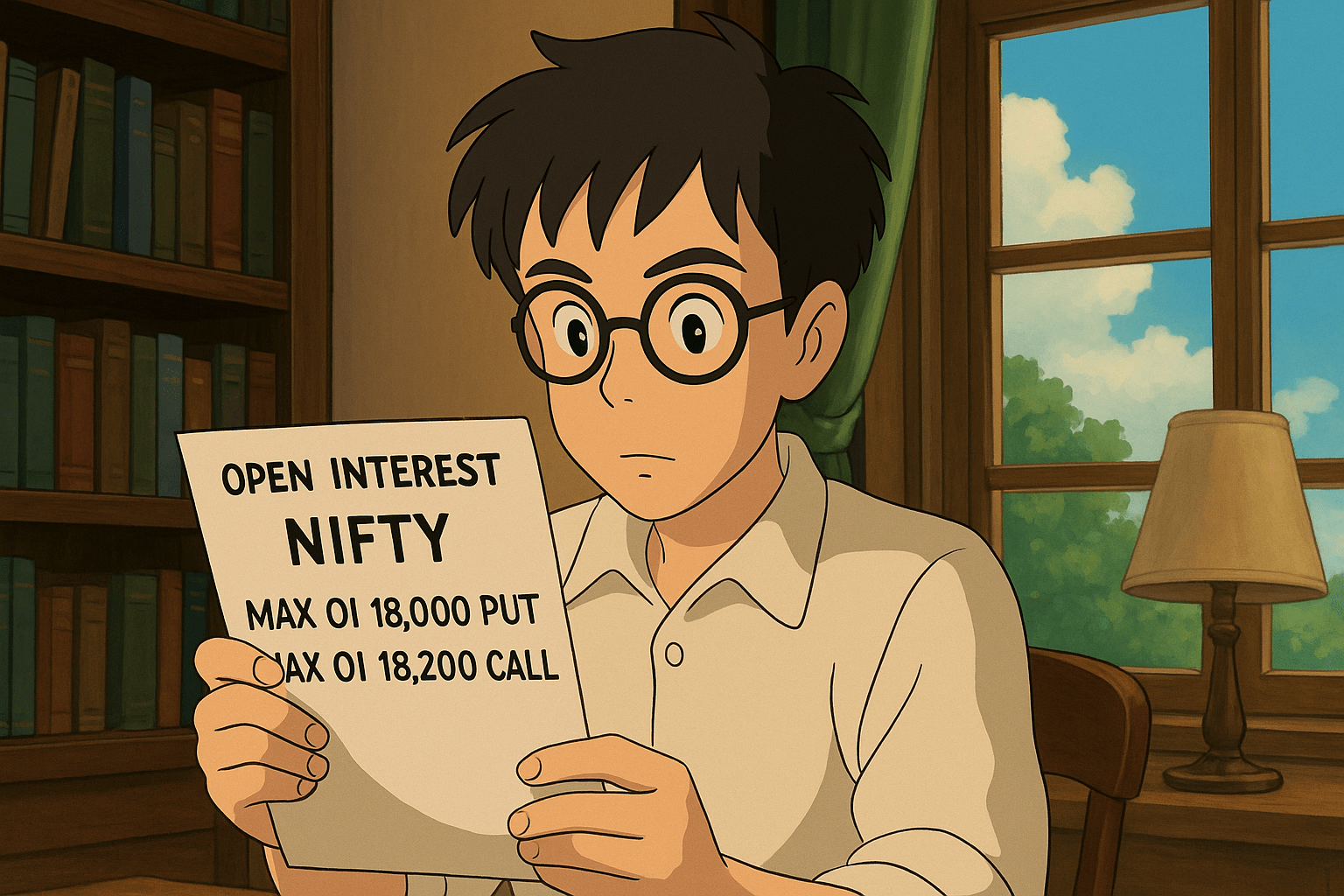

In our example, with Nifty near 18,000:

- Max OI at 18,000 Put: Traders see this level as a strong support, since put writers usually expect prices to stay above their strike.

- Max OI at 18,200 Call: This becomes a strong resistance, as call writers generally don’t expect the index to rise beyond their strike.

This creates a clear trading range between 18,000 and 18,200, even without looking at charts.

- If Nifty holds 18,000, it confirms bullish strength.

- If it breaks above 18,200, trapped call writers may cover, adding fuel to the rally.

- If it slips below 18,000, put writers may unwind, leading to faster downside.

Along with this open interest data, the price (premium change) helps in determining and understanding long build up vs short build up, which further indicates market sentiment.

Long build up means a rise in open interest along with a price increase, indicating fresh buying positions and bullish market sentiment, whereas Short build up means a rise in open interest along with a decline in price, indicating fresh selling positions and bearish market sentiment.

Want to get an in-depth understanding of open interest data for options trading? Then enroll in an options trading mentorship now and learn from market experts.

At Stock Pathshala, you get a personalized one-to-one session that helps you learn the core concepts and helps you polish your trading skills. For more understanding, book a counselling session now.

Mistakes to Avoid While Reading OI Data

Although OI provides valuable insights into the current and next moves in the market, relying solely on it can be a misguided choice.

Wondering what else should be checked along with OI data, here are other parameters:

- When examining OI alone, always consider it in conjunction with volume and price.

- Trusting random OI spikes: They can sometimes be hedges or noise, not true signals.

- Ignoring expiry: As expiry approaches, OI can change rapidly as traders roll over or close positions.

Conclusion

Open Interest is the heartbeat of the options market. It shows:

- Where fresh money is flowing in.

- Where positions are being closed.

- How strong is the conviction behind market moves?

Before investing capital, invest your time in learning Stock Market.

Fill in the basic details below and a callback will be arranged for more information: