In one of the conversations with big bull guests, I had a fascinating conversation with Shiv. Known for blending technical precision with real-world market psychology, Shiv had a unique way of simplifying complex trading concepts.

As we discussed moving averages, he dropped a line that instantly struck a chord:

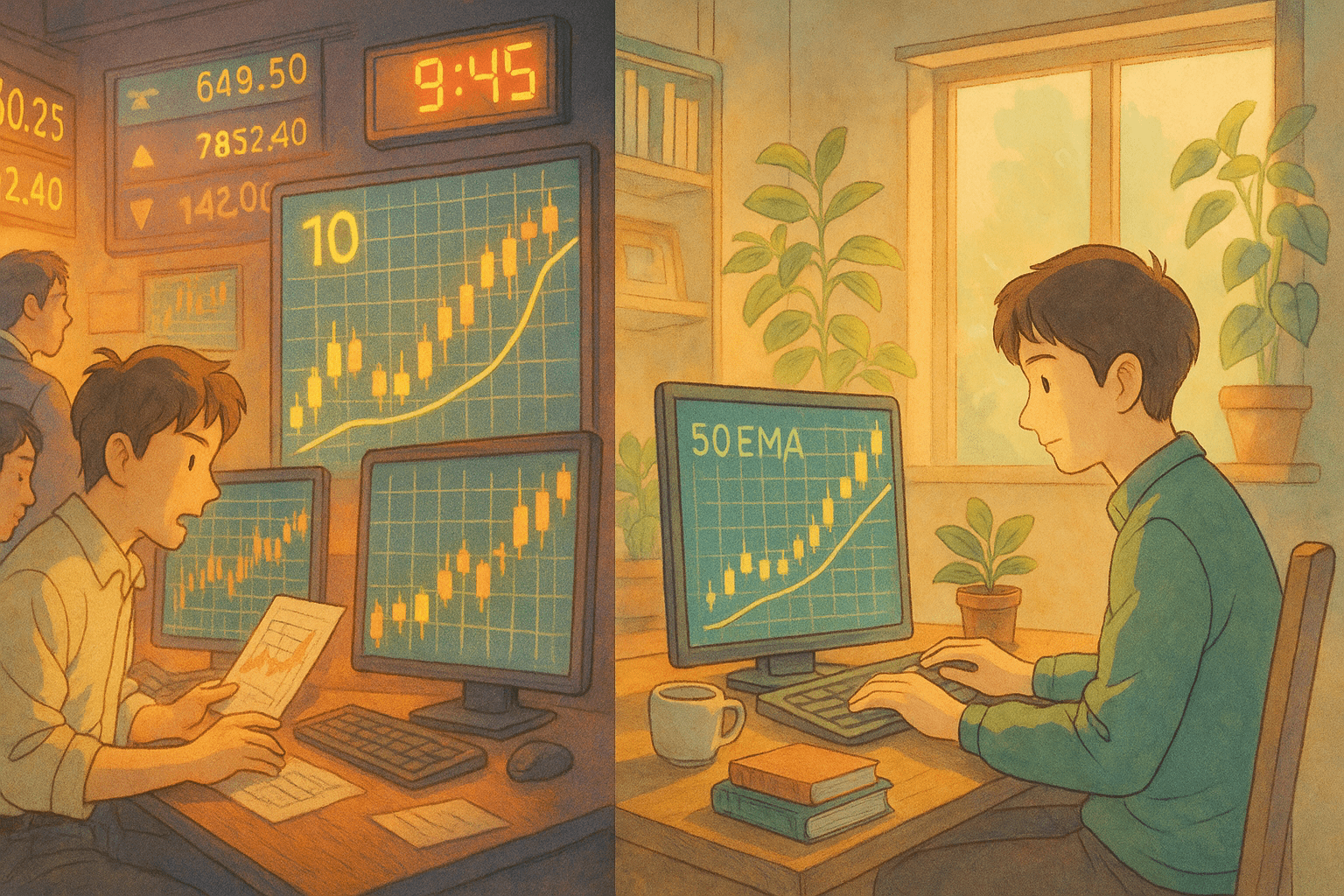

“If you love speed, trade on 10 EMA. If you want peace of mind, stick to 50 EMA.”

It was simple. Catchy. And surprisingly insightful.

The Meaning Behind the Line

I asked Shiv to elaborate.

He explained, “The 10 EMA (Exponential Moving Average) is for traders who want to move fast. It hugs the price closely, responds quickly to market shifts, and is ideal for short-term trades. But with that speed comes noise—false signals, quick reversals, and higher risk.”

In contrast, the 50 EMA gives you the ‘peace of mind’. It’s slower to react, but it filters out the noise. It’s preferred by swing traders and position holders who aren’t chasing every tick but want to ride strong trends with more confirmation and less panic.

10 EMA – For Speed Enthusiasts

“So, how does the selection of moving average categorize traders?” I asked.

He looked at the screen and, while explaining the concepts, added, “It is:

- Best for: Intraday & momentum traders

- Timeframes: 5-min, 15-min, 1-hour charts

- Pros: Quick entries, early signals

- Cons: More false breakouts, whipsaws”

In further added, “If you’re the type who likes fast setups and has the discipline to manage tight stop-losses, 10 EMA could be your ideal companion.”

50 EMA – For Calm & Conviction

“Okay, and when a trader must choose to use 50-EMA,” I asked.

“Simple, the one who wants peace,” he replied with a smile.

“Oh wow, so for someone in a full-time job,” I added.

“Exactly,” he nodded and further added, “It’s the kind of moving average that supports your decision when the market gets noisy,” he added. “It won’t get you in early, but it’ll get you in right and then added, that it is:

- Best for: Swing traders & trend followers

- Timeframes: Daily, 4-hour, Weekly charts

- Pros: Stronger support/resistance, fewer fakeouts

- Cons: Slower entries, wider stops.”

Shiv emphasized that when a stock bounces consistently from the 50 EMA, it reflects institutional confidence. “It’s the zone where strong hands accumulate,” he said.

He blended trading with spiritual wisdom and said, “Think of your palm holding ‘charan-amrit’—that sacred water touched by the divine feet. You wouldn’t dare to let it spill, right? You’d hold it with care and reverence.”

Then he connected it back to trading: “Your palm is the 50 EMA, and the water is the price. As long as the price stays above your palm, you must hold on to the trade. Don’t rush. Don’t overreact. Just hold with patience.”

That moment stayed with me. In just a few lines, Shiv had offered not only a trading insight but also a mindset shift. It wasn’t just about where to enter or exit—it was about how to stay in a trade with conviction.

It reminded me that some of the most effective trading strategies come not from indicators alone, but from a deeper understanding of patience, discipline, and trust in your setup.

So Which One Should You Use?

Shiv’s advice was grounded and practical:

“Use 10 EMA when the market is trending strongly and volatility is your friend, and 50 EMA when you’re focused on structure, patience, and want to avoid overtrading.”

He also warned against mixing them without clarity. “A confused trader using both ends up chasing speed without direction or waiting for peace that never comes.”

My Key Takeaway

Sometimes, it takes a single well-crafted sentence to reframe how we see our strategies.

“Speed or peace — your EMA reveals your personality as a trader.”

Shiv’s line wasn’t just witty—it was a reminder that tools like moving averages aren’t just indicators. They reflect how we want to engage with the market.

Before investing capital, invest your time in learning Stock Market.

Fill in the basic details below and a callback will be arranged for more information: