“So, Arif… Elliott Wave or Price Action — what’s better?” I asked

He smiled and replied, “Depends on what kind of trader you are.”

“But let’s talk about the differences — they’re more interesting than people think.”

I nodded. “I always thought Elliott Wave was too complicated. Price Action feels more… grounded.”

“Exactly!” Arif jumped in. “That’s the first difference — simplicity. Price Action is direct. You look at support, resistance, patterns like pin bars or engulfing candles — and boom, you’re in the game.”

“Right,” I said. “Even a beginner can get started with Price Action.”

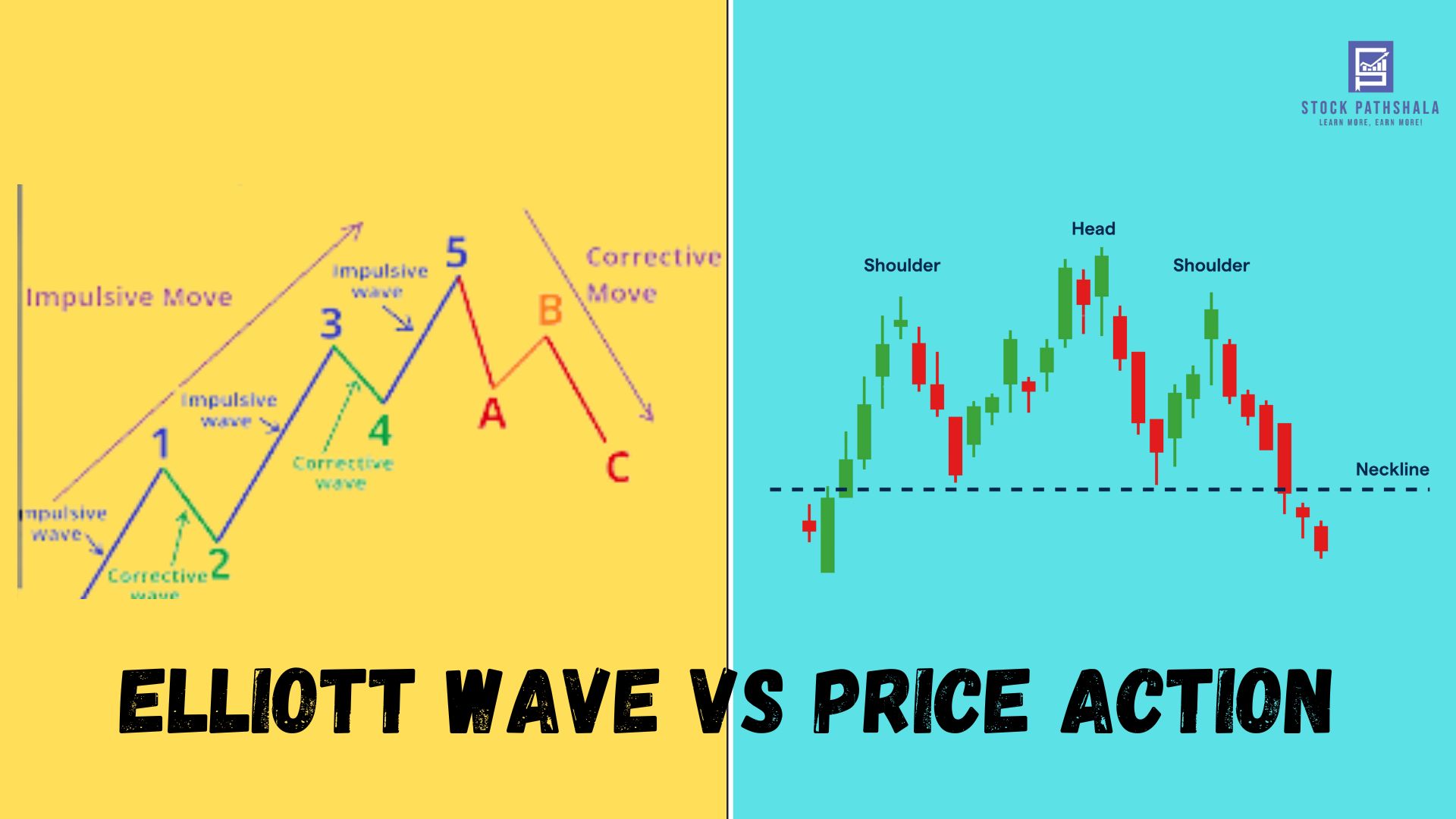

“But Elliott?” he continued, “It’s like a whole new language. You’ve got to count waves, know impulse vs corrective patterns, label properly… It’s powerful, but yeah—not for the impatient,” he chuckled.

I raised my eyebrow. “So one’s plug-and-play, and the other’s like assembling IKEA furniture without the manual.”

“Pretty much.”

1. Simplicity vs Complexity

“Okay,” I said, “what else?”

“Second thing — mindset,” Arif said. “Price Action is reactive. You wait for something to happen — a breakout, a reversal — then you act.”

“And Elliott?”

“Predictive,” he replied. “You try to figure out where the market is headed based on the wave count. If it’s in Wave 2, you prep for Wave 3. It’s like forecasting the weather using cloud patterns.”

I grinned. “Forecasting sounds risky.”

“It is. But when done right, it gives you a strong edge.”

2. Reaction vs Prediction

“Okay, so Price Action waits for the storm. Elliott tries to guess if it’ll rain tomorrow.”

“Exactly.”

I leaned forward. “What about timeframes? Can I use both for intraday?”

Arif shook his head. “Price Action shines on shorter timeframes — 5, 15, 30 minutes. But Elliott prefers the big picture — daily, weekly, even monthly. You need to see the whole trend unfold to count waves accurately.”

“That’s why Elliott traders always sound philosophical,” I joked.

“Because they’re looking at market cycles, not just candles,” he laughed.

3. Short-Term vs Big Picture

“Now I’m curious,” I said. “What happens if two Elliott traders look at the same chart? Do they get the same wave count?”

“Hardly,” Arif replied. “That’s another key difference. Price Action is more objective — we both see a double top or a pin bar and likely agree. But Elliott Wave? It’s subjective. One person’s Wave 3 might be another’s Wave A. There’s more room for interpretation.”

“Oh wow. So Price Action is like solving math with clear rules. Elliott is like modern art — open to how you see it.”

“Well put,” he smiled.

4. Objective vs Subjective

“So far,” I said, ticking it off on my fingers, “we’ve got simplicity, reaction vs prediction, timeframes, and clarity. What’s the fifth?”

“Understanding market cycles,” Arif said.

“Elliott Wave teaches you how markets behave emotionally — greed, fear, recovery, optimism. It gives you a macro view.”

“And Price Action?”

“More tactical. You’re looking at individual battles — support here, resistance there. It’s effective for entries and exits, but it doesn’t always tell you where you are in the larger market cycle.”

I leaned back, thinking. “So Price Action is like watching a match, reacting to every shot. Elliott is studying the entire season.”

“Exactly,” Arif nodded.

5. Micro Moves vs Market Psychology

We sat back for a moment.

“You know,” I said, “I used to think Elliott Wave traders were just drawing fancy lines.”

“And they used to think Price Action traders were oversimplifying things,” Arif replied, grinning.

We both laughed.

“But now I see,” I added, “it’s not one versus the other. It’s just different ways of reading the market.”

“Right,” Arif said. “Some traders even combine both — using Price Action for entry and Elliott for context.”

The episode was winding down. I looked into the mic.

“So, folks, there you have it — the honest chart talk. Whether you like the rhythm of candles or the poetry of waves, the key is practice and consistency. Thanks, Arif — that was deep.”

“Always a pleasure,” he said.

Conclusion

As our conversation wrapped up, I realized something important — there’s no single “right” way to read the market.

Some traders love the clean logic of Price Action, while others are drawn to the wave-like rhythm of Elliott Theory.

It all comes down to your personality, your trading goals, and how much time you’re willing to spend mastering the craft.

If you’re someone who likes quick decisions and simple setups, Price Action might be your best friend.

But if you enjoy the deeper psychology behind market moves and don’t mind some complexity, Elliott Wave can offer a fascinating lens.

In the end, the market doesn’t care what method you use — it rewards discipline, patience, and clarity.

So pick your path, learn it well, and as always, trade smart.

Before investing capital, invest your time in learning Stock Market.

Fill in the basic details below and a callback will be arranged for more information: