Corrections are an unavoidable part of investing. Picture this: your portfolio is climbing, headlines are cheerful, and even people who never cared about stocks are talking about their “hot picks.” Then, almost overnight, prices tumble 10% or more. That sudden drop is what we call a market correction. To avoid losses during that phase, it is important to learn how to identify market correction before it happens.

Corrections can feel scary, but they’re not disasters. They’re more like a reset, cooling an overheated market and paving the way for healthier growth.

If you know what signs to look for, you can prepare, protect your money, and even find great buying opportunities.

What Is a Market Correction?

A market correction is generally defined as a decline of 10% or more from recent highs.

Unlike crashes, corrections are short-term and healthy; they help shake out excess speculation before trends continue.

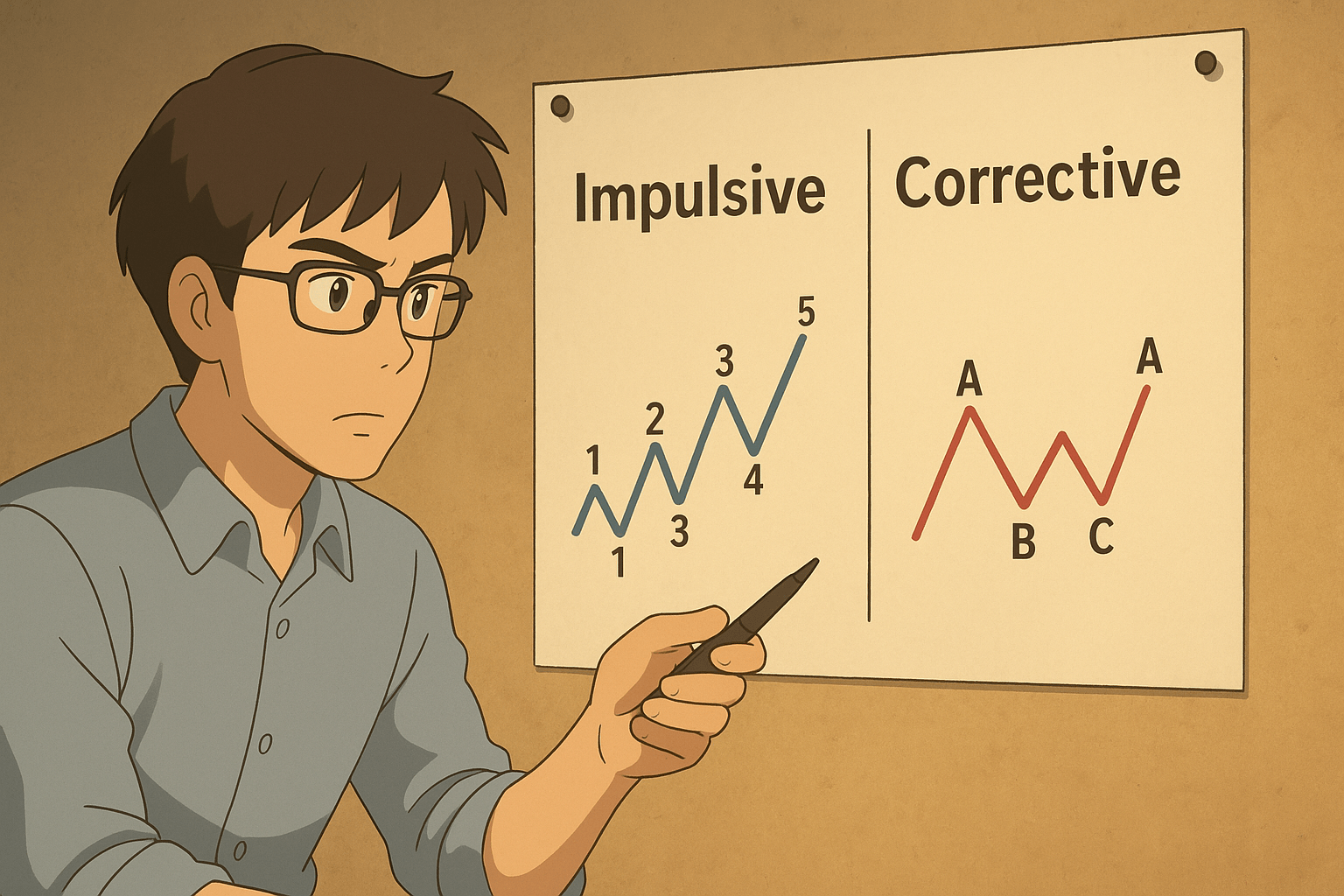

In fact, corrections often fit within larger Elliott Wave patterns.

After a strong, impulsive move higher, the market usually enters a corrective phase.

Recognizing this rhythm by understanding impulsive vs corrective waves can help you see corrections as normal breathing points in the market cycle.

Key Signs of a Market Correction

Here are the ways to identify and catch market corrections long before it happens:

1. When Excitement Turns Into Mania

Markets often peak when optimism becomes blind confidence:

- Everyone seems to have a stock tip.

- Analysts keep raising price targets endlessly.

- Social media buzz makes it sound like investing is a guaranteed win.

This kind of hype has historically been a signal that prices are stretched and due for a pullback.

2. Momentum Indicators Lose Strength

Even if prices are hitting fresh highs, the “engine” behind them sometimes starts weakening:

- Indexes dip below their 50-day or 200-day moving averages.

- RSI or MACD show slowing momentum.

- Rallies fade quickly instead of holding strong.

Think of it as a runner who looks fine but is starting to lose stamina—you know a slowdown is near.

3. Market Leaders Stop Leading

Every rally has champions—tech, small-caps, or energy. When those leaders stumble while defensive sectors (like utilities or consumer staples) quietly rise, the market’s character is changing.

Example: In early 2022, tech stocks faltered and energy shares took over. That leadership shift hinted that the rally was running out of steam.

4. Volatility Begins to Rise

Corrections rarely slip in unnoticed. The VIX index, often called Wall Street’s “fear gauge,” tends to climb before markets fall.

If volatility rises while stocks are still near their highs, traders are already bracing for turbulence.

5. Negative News Hits Harder

When sentiment is strong, markets shrug off bad headlines. As corrections approach, psychology flips:

- Small policy changes trigger big reactions.

- Inflation numbers spark sell-offs.

- News that once got ignored now shakes confidence.

It’s not the news itself—it’s how sharply investors react that signals a correction.

6. Heavy Selling on High Volume

- A small dip with low volume? Probably noise.

- A sharp drop with big trading volume? Institutions are selling.

When large players pull back, the rest of the market usually follows.

7. Weakening Economic Signals

Markets are forward-looking. If growth indicators like retail sales, factory output, or consumer confidence soften while stocks are still elevated, that mismatch often sets the stage for a correction.

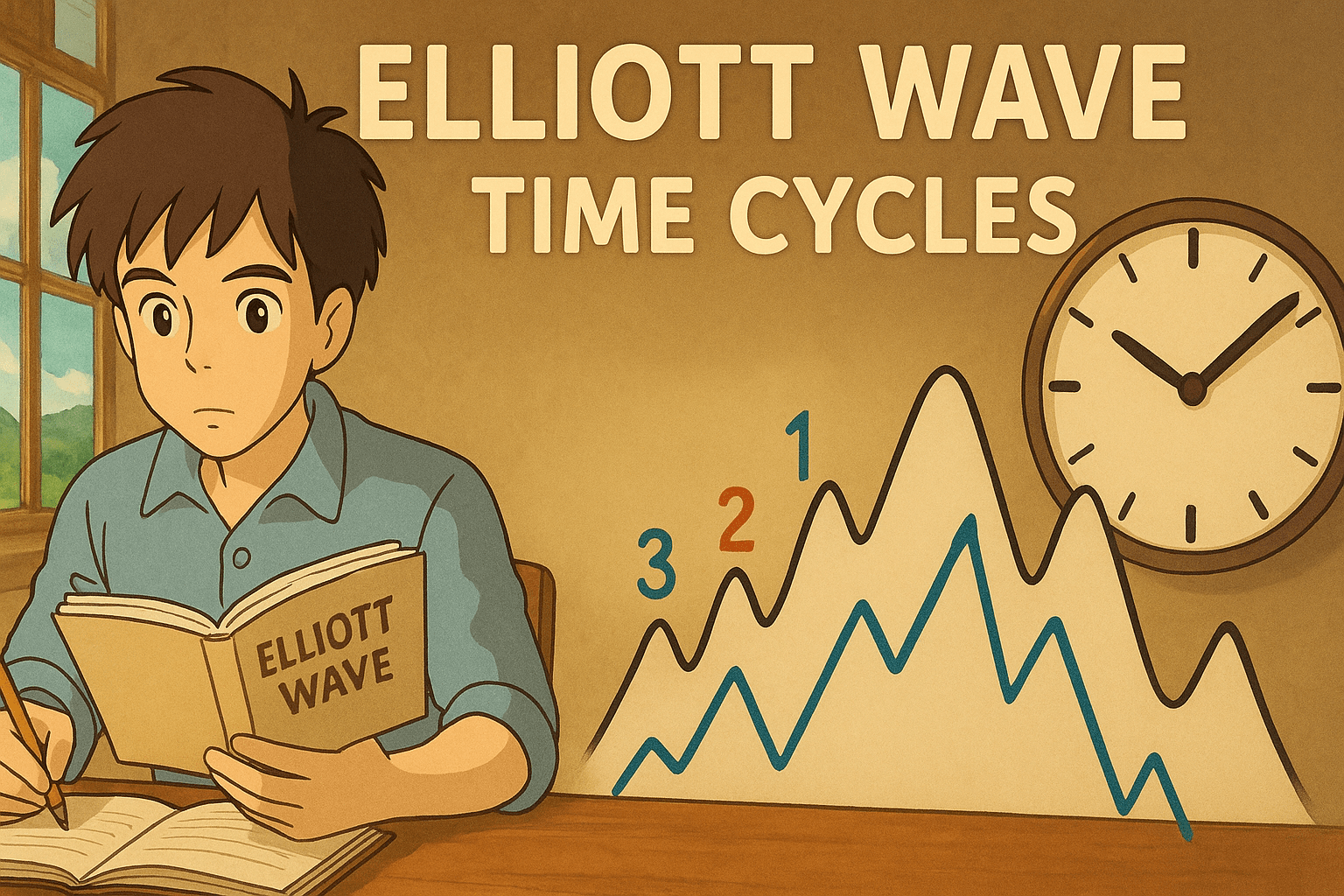

How Elliott Wave Helps in Identifying Market Corrections?

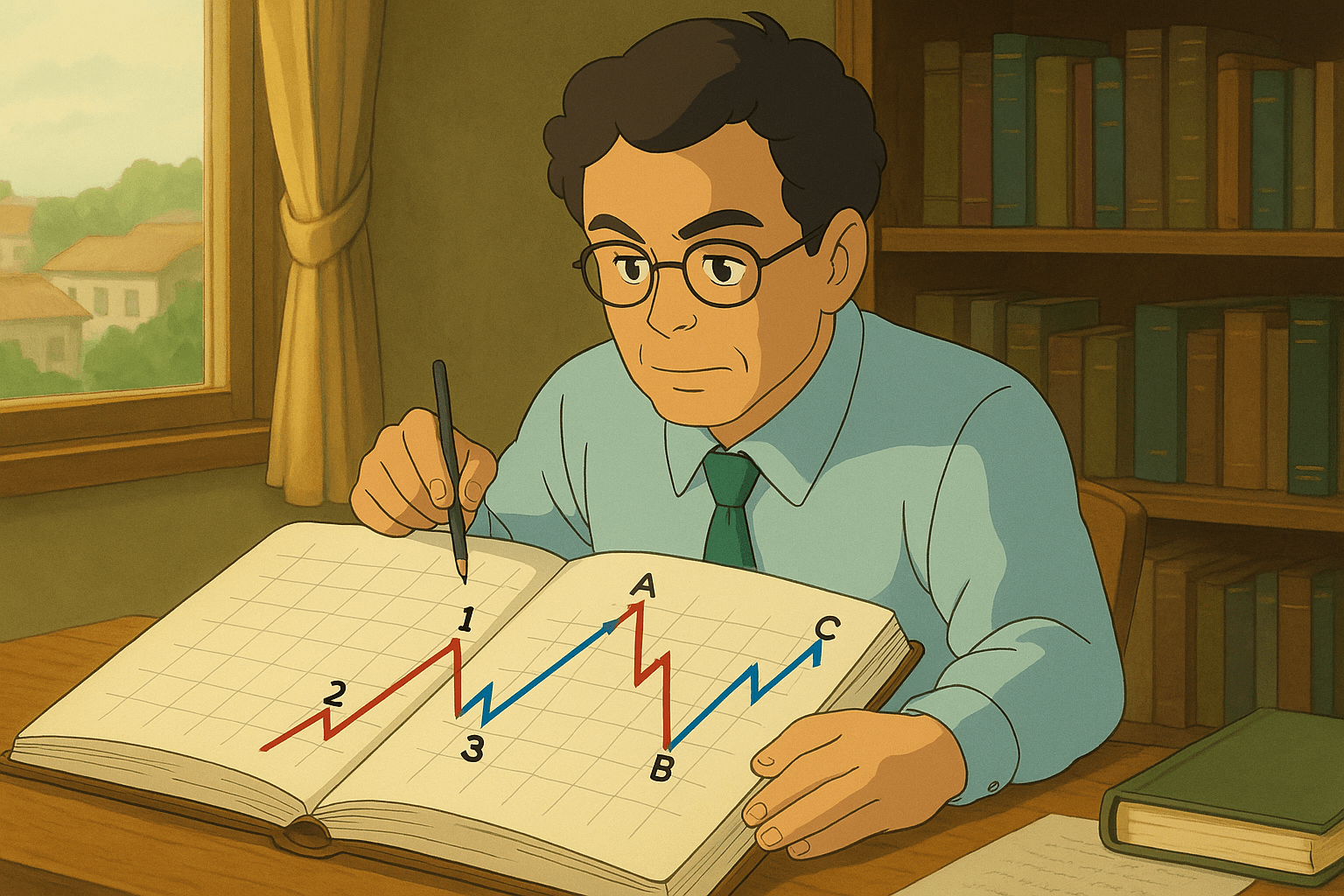

According to Elliott Wave theory, market moves unfold in two main phases:

- Impulsive waves (1–5): Strong, directional moves with energy.

- Corrective waves (A–C): The reset, when the market cools off.

A correction is essentially a wave A–C phase after a strong advance. Spotting this cycle can make corrections less frightening and more predictable.

Example: The 2020–2021 tech rally was a classic impulsive phase, followed by the 2022 correction that fit neatly into the A–B–C structure.

How to Prepare for a Market Correction

You can’t avoid corrections, but you can manage them wisely:

- Diversify: Spread your portfolio so one stock or sector doesn’t sink you.

- Hold Cash: Keep dry powder to buy bargains after corrections.

- Use stop losses: If you’re actively trading, stops can protect capital.

- Focus on Quality: Companies with strong balance sheets rebound faster.

- Stay Calm: Selling in panic often means missing the recovery.

Want to learn the concepts of how to identify wave patterns and market corrections in depth? Join our Elliott Wave mentorship now and get complete guidance and personalized learning experience from a top-notch mentor.

Final Thoughts

Corrections are part of the natural market cycle—they shake out excesses, reset prices, and create room for the next leg up. By combining traditional signals (momentum, volatility, news reaction) with wave analysis (impulsive vs corrective), you’ll have a clearer roadmap of where the market stands.

Great investors don’t fear corrections—they expect them, plan for them, and often see them as opportunities.

Before investing capital, invest your time in learning Stock Market.

Fill in the basic details below and a callback will be arranged for more information: