There are very few traders who can say this with full confidence—

“Mein Kabhi Bhe Loss Book Nahi Karta.”

And no, it’s not arrogance. It’s not about pretending to be perfect or avoiding mistakes.

It’s about mindset & planning.

And for Parth, our guest on the Big Bull Podcast, it’s a principle that has helped him build consistent returns—40% annually through swing trading, to be precise.

When I sat down to understand how he does it, I expected some complex strategy or secret formula.

But what I discovered instead was surprisingly simple: discipline, observation, and a screener so straightforward, even beginners can relate to it.

The Day Starts at 7

To kick things off, I asked him how a typical day looked.

He didn’t hesitate. “I wake up at 7 AM, and by 7:30, I’m at my screen,” he said with quiet confidence.

That surprised me. “7:30? That’s nearly two and a half hours before the market even opens!”

Parth gave a calm nod. “I spend that time doing pre-market analysis on my shortlisted stocks. I also tune into the news.”

At first, I assumed he was tracking stock-related updates. But he quickly corrected that notion.

“No, I stay away from news-based stocks,” he clarified. “I watch the news to understand global markets, political situations, major events… things that move the market indirectly.”

He leaned forward slightly, voice steady. “It helps me think ahead and connect dots.”

That last line stuck with me. It showed how he wasn’t just watching, he was interpreting.

And sometimes, those quiet morning observations lead him to the kinds of ideas others overlook.

From Obvious Headlines to Hidden Opportunities

He suddenly perked up as if remembering something.

“Let me give you an example,” he said.

“You must have noticed how tourism has picked up recently. It’s everywhere—media, news, even government updates.”

Naturally, I assumed he jumped into hotel stocks.

But Parth shook his head. “I didn’t go for hotels.”

“Really?” I raised an eyebrow. “So, how did you take advantage of the trend?”

“I picked BLS International,” he said with a slight smile, as if letting me in on a secret.

He explained, “It’s India’s only listed visa processing company.”

And just like that, he had shifted the conversation from the obvious to the insightful.

That was the moment it hit me—he doesn’t chase the headline, he reads between the lines.

He connects macro stories to micro opportunities.

But spotting the right theme is just the beginning.

The real game, he told me, lies in picking the right stock.

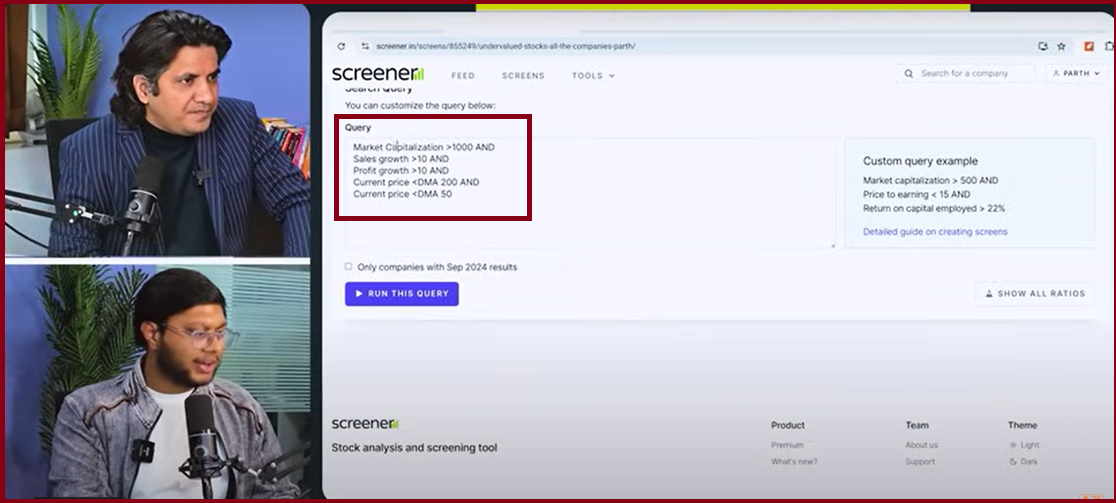

Parth’s Personal Swing Trade Screener

I was curious. “Okay, so this was one example. But generally, how do you pick your stocks, especially since you follow the mindset of never exiting in a loss?”

With a humble nod, he said, “I have built a simple screener over time. Let me break it down.”

Here’s what he shared:

- Market Cap > ₹1000 Crore

- Sales Growth > 10%

- Profit Growth > 10%

- Current Price < 200 DMA

- Current Price < 50 DMA

“Once I apply these filters,” he continued, “I sort the results based on PE ratio.”

I tilted my head. “Why the PE sort?”

“To identify undervalued companies that are still growing,” he explained. “I usually avoid stocks with a PE above 40, unless there’s a very strong reason—like explosive future potential.”

He wasn’t done yet.

“Fundamentals are important, but I also dive deeper. I study the business model, understand the company’s positioning, and check for competition.”

That’s when I realized—his process blends both fundamental and technical analysis, in a way that’s neither too rigid nor too loose.

Sentiment: The Invisible Filter

Just as I was absorbing all that, he added another layer.

“I also adjust my criteria depending on market sentiment.”

This caught my attention.

“In bearish conditions,” he explained, “I want stronger companies—ones showing 20%+ growth in sales and profits.”

“But when the market is bullish?” I asked.

“Then 10% growth is usually enough,” he said. “Momentum takes care of the rest.”

What struck me most was how calmly he spoke about waiting for the setup, even when others would panic or rush in.

He’s learned, through experience, that bear markets push good stocks below their fair value—a window of opportunity if you’re patient and prepared.

What I Took Away from Parth

This wasn’t just a conversation about screeners or market filters.

It was about conviction.

Parth doesn’t panic when things turn red. He doesn’t chase when things go green. He trusts the system he built. He sticks to it, day after day.

And maybe that’s why he says it so clearly—

“Mein Kabhi Bhe Loss Book Nahi Karta.”

Because the loss? It only becomes real when you give up on your logic.

And Parth doesn’t.

Before investing capital, invest your time in learning Stock Market.

Fill in the basic details below and a callback will be arranged for more information: