You know how the ocean has waves? Big ones, small ones, but they all follow a rhythm? Well, traders believe the stock market also moves in “waves.” This idea is called Elliott Wave Theory and what’s more interesting in this is that it is based on time frame. So let’s dig deeper to understand elliott wave time analysis concepts in detail.

How to Use Time Analysis in Elliott Wave?

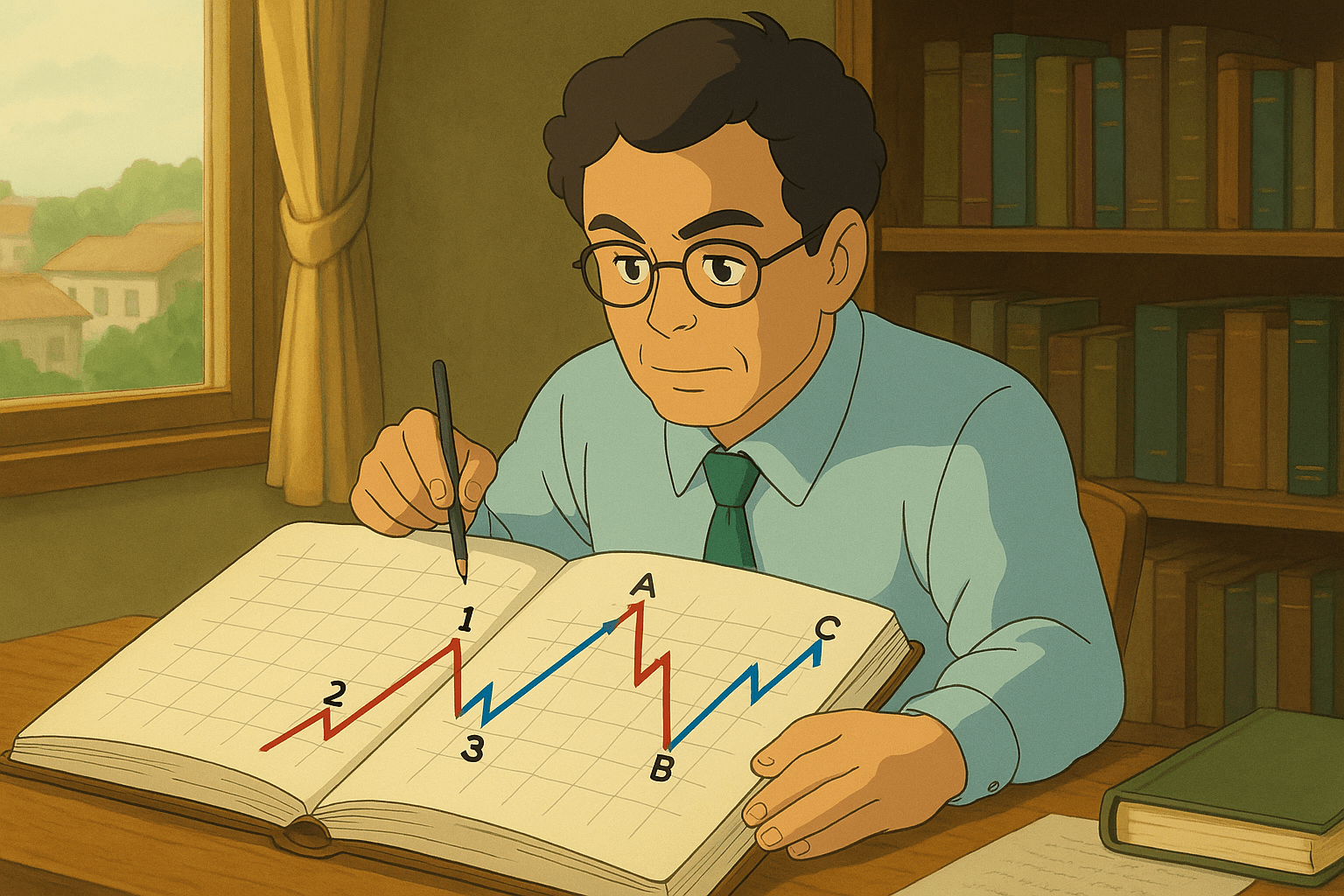

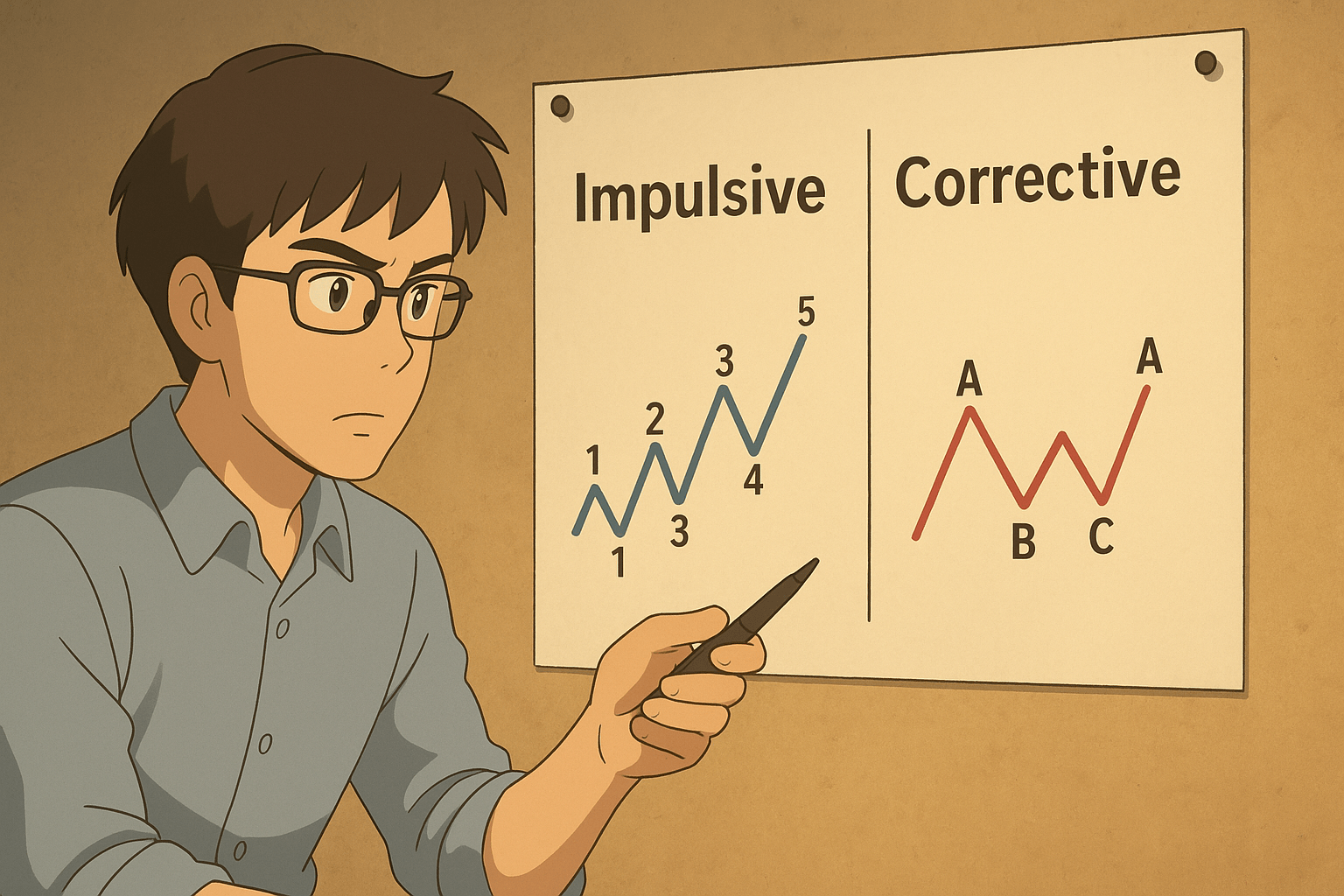

If we dig deeper into how to identify wave patterns, you can usually relate it to the fact that Elliott waves are usually 5 waves going up and then 3 waves going down. Cool, right?

But here’s the tricky part: even if you know which wave you’re on, you don’t know when the next big wave is coming.

That’s where Time Cycles come in.

Let’s understand in more detail.

Imagine you’re timing how long your friend takes to run across the playground. If it took them 20 seconds the first time, maybe next time it takes around 32 seconds (20 × 1.618 — a special number traders use).

Traders do the same with the market: they measure how long old waves lasted, then guess when the next one might finish.

It doesn’t give an exact date, but it shows a “time window” where something big might happen.

And that’s super helpful, but why more focus on time than in price?

Why Time Analysis in Elliott Wave?

Most traders only look at price—like “Is this stock cheap or expensive?”

But if you only look at price, you might buy too early, or sell way too late.

But Time cycles help you in other ways. It helps you to:

- Get in and out at better moments.

- Avoid “false starts” (buying before the real move happens).

- See the market’s rhythm, kind of like how music has beats.

In simple terms,

- Price tells you where.

- Time tells you when.

Put them together? You’re suddenly a smarter trader.

What Research Shows

This isn’t just guessing—people have actually tested it:

- India’s NIFTY index often moves in cycles of around 82 days.

- Copper prices show repeating patterns, from big waves to tiny ones.

- Some traders even mix Elliott Waves with other timing tools (like Hurst Cycles and Fibonacci numbers) to double-check.

How to Use Time Cycles?

Here’s their playbook:

- Measure how long past waves lasted.

- Multiply by special ratios (like 0.618 or 1.618).

- Mark future “time windows” on the chart.

- Wait for extra clues (candlestick shapes, volume spikes, momentum shifts).

They’re not trying to be fortune tellers—they’re stacking the odds in their favor.

Benefits of Time Analysis in Elliott Wave

Every aspect of trading holds benefits and drawbacks. Here are some of the pros of using time analysis in Elliott Wave:

- Helps with better timing (no FOMO or panic).

- Works on stocks, gold, oil, forex—even crypto.

- Plays nicely with other tools like RSI or MACD.

- Gives structure instead of random guessing.

Drawbacks of Time Analysis in Elliott Wave

Let’s not forget to look at the other side of time cycles:

- If you label the waves wrong, your whole timing idea falls apart.

- Some traders get overconfident and ignore risks.

- Too many timing tools can make things confusing.

- Markets don’t always “behave”—sometimes cycles just don’t show up.

Want to avoid such mistakes in your trading? Then join the Elliott Wave mentorship program and get personalized guidance in upgrading your skills.

For more details, book a counselling now!

Final Thoughts

No system is perfect. Time cycles feel magical when they work, but they can trick you into “seeing patterns” that aren’t really there.

Smart traders use them as guides, not guarantees. They still keep stop-losses, manage risk, and never bet everything on one prediction.

Elliott Wave Time Cycles don’t make you a wizard who can call the exact day the market will turn. But they do give you something powerful: a sense of timing.

Instead of only asking “Where will the price go?”, you start asking “When might it move?”.

And that little shift in thinking? It can save you from a lot of mistakes—and make trading feel more like strategy and less like guessing.

Before investing capital, invest your time in learning Stock Market.

Fill in the basic details below and a callback will be arranged for more information: